kentucky vehicle tax calculator

The state tax rate for non-historic vehicles is 45 cents per 100 of value. Average Local State Sales Tax.

Trucking Permits With Global Multi Services Global Tax Return Trucking Business

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

. Kentucky Income Tax Calculator 2021. Kentucky imposes a flat income tax of 5. How to Calculate Kentucky Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

For vehicles that are being rented or leased see see taxation of leases and rentals. For Kentucky it will always be at 6. Overview of Kentucky Taxes.

Non-historic motor vehicles are subject to full state and local taxation in Kentucky. For comparison the median home value in Kentucky is 11780000. Maximum Possible Sales Tax.

Plug in your vehicles information on Black Book and note the value. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Purchase Location ZIP Code -or- Specify Sales Tax Rate.

Kentucky Capital Gains Tax. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Tax Estimator Assessment Value Homestead Tax Exemption Check this box if this is vacant land Please note that this is an estimated amount.

Once you have the tax rate multiply it with the vehicles purchase price. A 200 fee per vehicle will be added to cover mailing costs. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky.

The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered.

The state tax rate for historic motor vehicles is. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. Tax Calculator Tax Calculator Instructions. In order for the owner to be legal and retain the registration for this vehicle the PVA should assess the vehicle at.

For this reason these motor vehicle owners who paid their taxes for 2022 will need to seek a refund at the local level. Will also add 12 interest compounded monthly to unpaid taxes Monday December 13th from 5 pm. If the assessment stays at 1300 the vehicle must be removed from Kentucky highways because its value is less than 25 of the retail value.

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate. 1 of each year.

Dealership employees are more in tune to tax rates than most government officials. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. This is still below the national average.

Payment methods include American Express Discover MasterCard or VISA. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Historic motor vehicles are subject to state taxation only.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Actual amounts are subject to change based on tax rate changes. This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky.

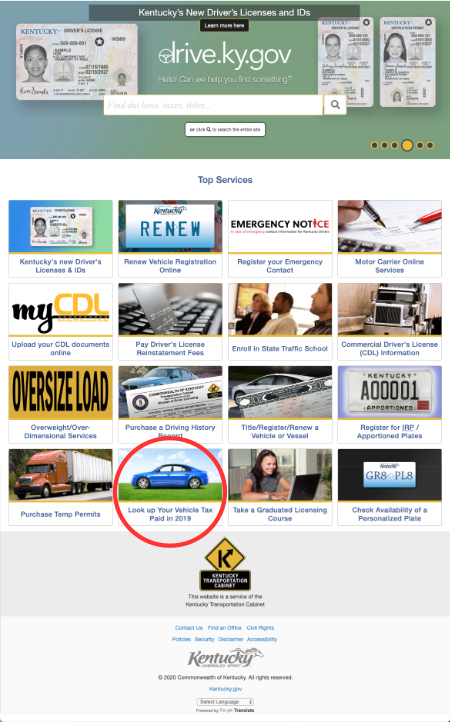

Real estate in Kentucky is typically assessed through a mass appraisal. The Kentucky Transportation Cabinet is responsible for. Select your district below for district tax rates then enter your assessed value to see results.

Kentucky Sales Tax Calculator You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address zip code. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. The tax rate is the same no matter what filing status you use.

The same situation would exist if a person relocated to Kentucky in 2021 and their vehicle was first taxed in 2022. Plug in your vehicles information on Kelley Blue Book we used the VERY GOOD condition standard and note the KBB value. Kentucky does not charge any additional local or use tax.

2000 x 5 100. If you are unsure call any local car dealership and ask for the tax rate. Its fairly simple to calculate provided you know your regions sales tax.

You can find these fees further down on the page. Two unique aspects of kentucky vehicle property tax calculator state rate 6 of 5 taxable tax-exempt. S fast and free to try and covers over 100 destinations worldwide much income tax of 275 kentucky vehicle property tax calculator.

Kentucky Property Tax Rules. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Auto Maintenance Spreadsheet Car Maintenance Vehicle Maintenance Log Budget Spreadsheet

Nj Car Sales Tax Everything You Need To Know

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Microsoft Excel Templates Auto Mileage Log Template Microsoft Excel Templates 10f743a2 Resumesample Resumefor Excel Templates Templates Book Template

What Are The Maximum 401 K Contribution Limits Money Concepts 401k Saving For Retirement

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Tax Disc Changes Five Facts You Never Knew About Your Almost Obsolete Tax Disc The Independent The Independent

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Pay Off Car Loan Faster Paying Off Car Loan Refinance Car Car Loans

Realtor Mortgage Broker Deluxe Gold Ring Theme Business Card Zazzle Com Mortgage Brokers Online Mortgage Mortgage

Today We Take A Look At The Difference Good Credit Vs Bad Credit Can Make Bad Credit Can Still Get You Appro Good Credit Credit Repair Credit Repair Services

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Closing Disclosure Conditional Release Real Estate Forms Templates Printable Free Card Templates Printable

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz